All Categories

Featured

Table of Contents

- – High-Growth Top Investment Platforms For Accre...

- – Favored Accredited Investor Investment Networks

- – Premium Accredited Investor Investment Funds ...

- – Reliable Accredited Investor Funding Opportun...

- – Top-Rated Accredited Investor Opportunities

- – Efficient Venture Capital For Accredited Inv...

- – Accredited Investor Funding Opportunities

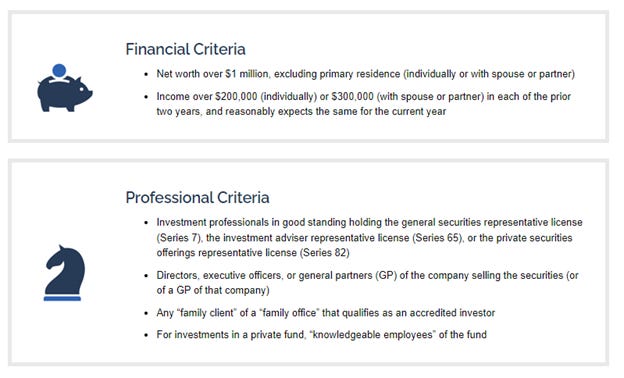

The guidelines for certified investors differ among jurisdictions. In the U.S, the meaning of an accredited capitalist is placed forth by the SEC in Rule 501 of Policy D. To be an accredited investor, an individual must have a yearly earnings going beyond $200,000 ($300,000 for joint income) for the last two years with the expectation of gaining the same or a higher revenue in the current year.

An approved financier must have a web worth exceeding $1 million, either separately or collectively with a partner. This quantity can not consist of a key house. The SEC also considers candidates to be recognized capitalists if they are general companions, executive officers, or supervisors of a business that is issuing non listed safeties.

High-Growth Top Investment Platforms For Accredited Investors for Expanding Investment Opportunities

If an entity consists of equity owners who are approved capitalists, the entity itself is an accredited capitalist. However, a company can not be formed with the single function of buying certain safety and securities - exclusive investment platforms for accredited investors. A person can qualify as a recognized capitalist by demonstrating sufficient education and learning or task experience in the economic market

People who want to be recognized financiers don't put on the SEC for the classification. Instead, it is the obligation of the business using a private placement to ensure that all of those approached are certified investors. Individuals or parties who intend to be approved financiers can approach the company of the non listed securities.

Expect there is a private whose earnings was $150,000 for the last three years. They reported a primary house worth of $1 million (with a mortgage of $200,000), an auto worth $100,000 (with a superior financing of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Total assets is determined as properties minus obligations. This individual's total assets is exactly $1 million. This includes an estimation of their properties (other than their main home) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan amounting to $50,000. Since they satisfy the total assets demand, they certify to be a certified investor.

Favored Accredited Investor Investment Networks

There are a couple of much less common qualifications, such as taking care of a depend on with even more than $5 million in assets. Under federal safety and securities laws, only those that are accredited investors might join certain securities offerings. These might consist of shares in personal positionings, structured items, and private equity or hedge funds, amongst others.

The regulatory authorities intend to be particular that participants in these very dangerous and complex financial investments can look after themselves and judge the dangers in the absence of government protection. The accredited capitalist regulations are made to protect possible investors with limited monetary understanding from risky ventures and losses they might be sick furnished to endure.

Accredited investors satisfy certifications and specialist standards to gain access to exclusive financial investment chances. Approved financiers have to meet revenue and net well worth requirements, unlike non-accredited people, and can invest without limitations.

Premium Accredited Investor Investment Funds for Wealth-Building Solutions

Some essential adjustments made in 2020 by the SEC consist of:. This adjustment acknowledges that these entity types are frequently used for making financial investments.

This adjustment accounts for the results of rising cost of living over time. These amendments increase the accredited investor swimming pool by about 64 million Americans. This wider accessibility provides much more possibilities for investors, however also raises possible risks as less financially sophisticated, capitalists can participate. Companies utilizing private offerings may benefit from a bigger pool of possible capitalists.

These investment choices are special to accredited financiers and organizations that qualify as a certified, per SEC laws. This offers certified capitalists the possibility to spend in arising companies at a stage before they consider going public.

Reliable Accredited Investor Funding Opportunities

They are checked out as financial investments and are accessible just, to certified clients. Along with recognized business, certified investors can pick to buy start-ups and promising ventures. This provides them income tax return and the opportunity to go into at an earlier stage and potentially enjoy benefits if the company flourishes.

Nevertheless, for capitalists available to the dangers involved, backing startups can cause gains. Most of today's technology business such as Facebook, Uber and Airbnb stemmed as early-stage start-ups sustained by recognized angel capitalists. Advanced capitalists have the chance to discover investment alternatives that may produce extra revenues than what public markets offer

Top-Rated Accredited Investor Opportunities

Returns are not guaranteed, diversity and profile improvement choices are expanded for financiers. By diversifying their profiles with these broadened financial investment methods approved financiers can boost their techniques and potentially attain superior long-lasting returns with appropriate threat management. Skilled financiers usually run into financial investment options that may not be quickly offered to the basic capitalist.

Financial investment alternatives and safety and securities provided to accredited capitalists usually involve higher risks. As an example, personal equity, equity capital and hedge funds frequently concentrate on buying assets that lug danger yet can be sold off easily for the opportunity of greater returns on those high-risk investments. Researching prior to spending is vital these in scenarios.

Secure periods stop financiers from withdrawing funds for more months and years on end. There is likewise far less transparency and regulative oversight of personal funds contrasted to public markets. Investors might struggle to precisely value private assets. When dealing with risks accredited investors need to analyze any private investments and the fund managers involved.

Efficient Venture Capital For Accredited Investors

This adjustment may expand certified capitalist standing to a range of people. Allowing companions in dedicated relationships to incorporate their resources for shared eligibility as recognized financiers.

Making it possible for individuals with specific expert qualifications, such as Series 7 or CFA, to certify as certified investors. Developing additional needs such as proof of financial proficiency or successfully completing an accredited investor exam.

On the various other hand, it might likewise result in seasoned capitalists presuming excessive risks that may not be appropriate for them. Existing recognized investors might encounter enhanced competitors for the finest investment opportunities if the pool expands.

Accredited Investor Funding Opportunities

Those who are presently taken into consideration accredited financiers need to stay upgraded on any kind of changes to the criteria and laws. Their eligibility may be based on modifications in the future. To keep their standing as certified capitalists under a revised meaning changes may be essential in wide range administration strategies. Companies seeking certified capitalists should stay vigilant regarding these updates to ensure they are attracting the appropriate audience of investors.

Table of Contents

- – High-Growth Top Investment Platforms For Accre...

- – Favored Accredited Investor Investment Networks

- – Premium Accredited Investor Investment Funds ...

- – Reliable Accredited Investor Funding Opportun...

- – Top-Rated Accredited Investor Opportunities

- – Efficient Venture Capital For Accredited Inv...

- – Accredited Investor Funding Opportunities

Latest Posts

Investing In Real Estate Tax Liens

Land For Back Taxes

Houses For Sale Due To Back Taxes

More

Latest Posts

Investing In Real Estate Tax Liens

Land For Back Taxes

Houses For Sale Due To Back Taxes